07 Feb Domo Inc: Will Its Cloud Platform Help it Reach the Skies?

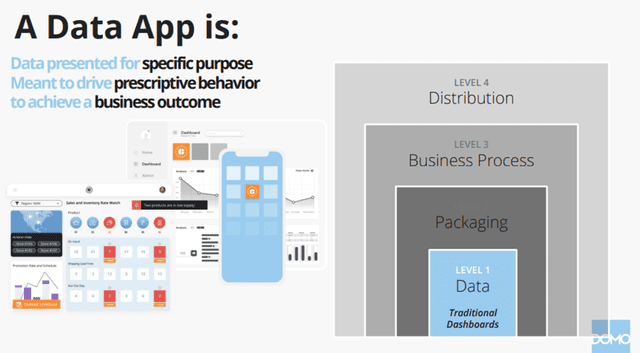

Domo, Inc. (NASDAQ: DOMO) is known for Business Cloud, its business intelligence software platform through which data from across the business can be collected, stored, prepared, organized, analyzed, visualized, and shared.

Business Cloud offers customizable, real-time and interactive self-service dashboards that can be personalized for every user as well as the ability to build custom data apps that can be shared externally.

Image Source: Company

The Product

The Business Cloud platform is aimed at fostering collaboration and efficient decision making and also increasing organizational productivity to generate improved business results.

The platform offers real-time access to quantitative and qualitative data, including through more than 1,000 powerful first-class connectors as well as a library of very flexible universal connectors. In addition, through Domo Workbench, organizations can connect to proprietary data sources regardless of where those data sources reside within an organization.

The aim of Domo’s comprehensive approach is to enable employees to design customized, real-time views of data and data trends. For example, a marketer can design a visualization that includes real-time data of the click-through rates of the online advertisements, the impact of regional marketing campaigns, and the benchmarks of his organization’s campaigns across the years.

The platform also uses ongoing variance analysis to provide personalized, proactive alerts, recommend actions to every employee and write back to source applications based on predetermined actions that are triggered after certain thresholds or behaviour has occurred. In the case of a bakery, for example, the platform can alert the owner that she does not have enough flour to meet tomorrow’s demand and recommend a supply schedule to prevent future stock-outs.

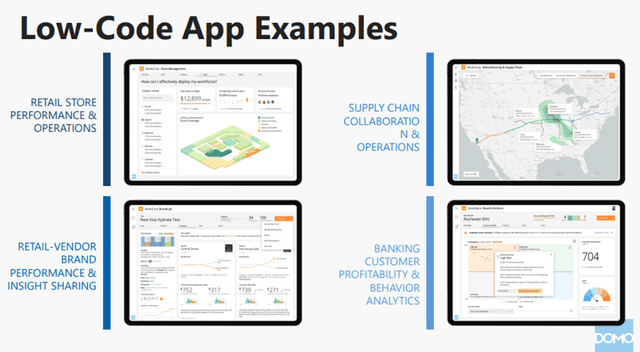

Image Source: Company

Though the Company’s product offering seems promising, a comprehensive analysis based on the following pertinent factors would reveal a clearer picture of Domo’s future prospects.

Revenue and Profitability Trend

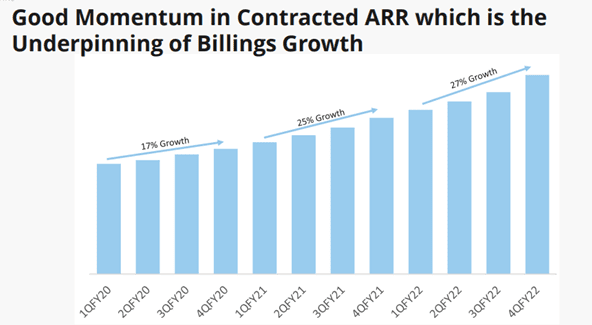

For the years ended January 31, 2020, 2021 and 2022, the Company had total revenue of $173.4 million, $210.2 million and $258.0 million, respectively, representing year-over-year growth of 21% and 23% for the years ended January 31, 2021 and 2022, respectively.

For FY25, the Company has a billings target of $500 million, which seems achievable given the current momentum in contracted annual recurring revenue (ARR).

Image Source: Company

Having said that, it is to be noted that the Company reported net losses of $125.7 million, $84.6 million and $102.1 million for the years ended January 31, 2020, 2021 and 2022, respectively. In fact, Domo Inc. has incurred significant losses since its inception in 2010 and had an accumulated deficit of $1,224.5 million at January 31, 2022.

Hence, though revenues seem to be growing at a good pace, Domo’s significant operating expenses continue to keep profitability weighed down. For FY22, sales and marketing, research and development and general and administrative expenses were 56%, 31% and 21% of revenues respectively. The Company has stated that it expects sales and marketing expense to increase in the near term as they continue to invest in the growth of the business. As such, it seems that even in the face of increasing revenues, the Company will be unable to clock substantial profits, at least in the near future.

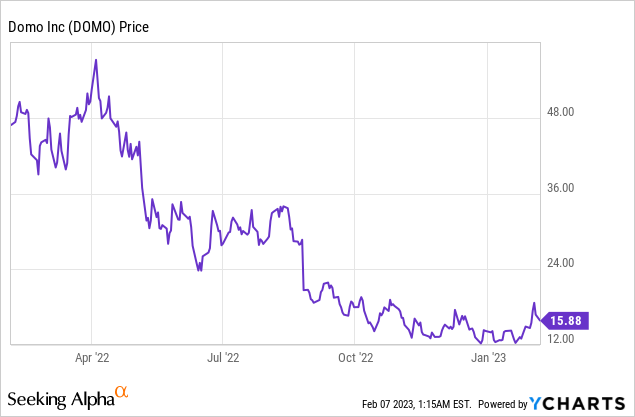

Domo, Inc. (NASDAQ: DOMO)

Market Cap: $548.58M; Current Share Price: $15.88

Data by YCharts

Negative cash flows and poor liquidity

For the years ended January 31, 2020, 2021 and 2022, the Company experienced negative cash flows, including cash used in operating activities of $80.2 million, $15.9 million and cash provided by operating activities of $0.4 million.

Most recently, for Q3 FY22, net cash used in operating activities was $6.5 million.

As of January 31, 2022, Domo had cash and cash equivalents of $83.6 million and no amounts available to draw under credit facility.

For Q3 FY22, cash, cash equivalents, and restricted cash position was even weaker at $71.1 million.

Negative cash flows and a weak cash position can greatly hamper the Company’s product development and sales marketing efforts, as they may not get access to adequate funds at favourable terms. In that case they would probably need to reduce expenses to manage liquidity, and unfortunately, any such reduction is quite likely to adversely impact their business growth and competitive position.

Competitive analysis

Currently, Domo has a competitive advantage because so far software companies have not offered solutions that meet the needs of an organization with respect to providing real-time intelligence on business operations to all users, from the CEO to the frontline.

Nevertheless, many features of Domo’s platform compete with products offered by

It is very likely that the large software vendors who currently do not have a competitive offering, some of which operate in adjacent product categories today, may in the future bring a solution to market through product development, acquisitions or other means that would compete with Domo’s offering. In addition, several of the Company’s competitors mentioned above have greater name recognition, much longer operating histories, more and better-established customer relationships, larger sales forces, larger marketing and software development budgets and significantly greater resources than Domo. Hence it seems unlikely that Domo will be able to maintain significant advantage over competitors in the future.

Low Possibility of Innovation and Lack of Diversified Product Offerings

The key factors for Domo’s growth strategy include increasing overall customer base, accelerating expansion within existing customers, extending platform functionality, expanding the Domo ecosystem and leveraging the data.

In other words, their growth strategy seems to be primarily focussed on attracting new customers and expanding within existing customer groups. There is not much mention of introducing new and innovative products that may appeal to other target groups and thereby help the Company create new streams of revenues.

As already discussed earlier, as larger companies innovate and introduce new products to compete with Domo’s platform, the Company may find it difficult to attract new customers or even maintain existing ones, in the absence of new and innovative product offerings.

To summarize, Domo seems to be displaying sustainable double-digit growth in terms of revenues, and seems to be doing well when it comes to customer retention as well. However, its cash positions and product offerings are weak and unlikely to improve in the near future. Hence, a preliminary study indicates that the Company may have fragile future prospects and hence it’s prudent to proceed with caution as far as investment in Domo Inc. is concerned.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://s26.q4cdn.com/900411403/files/doc_presentations/IR-PRESENTATION-3.pdf

https://www.sec.gov/ix?doc=/Archives/edgar/data/1505952/000150595222000012/domo-20220131.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1505952/000150595222000029/domo10q-20221031.htm

No Comments