09 Feb Lemonade Inc: A Buying Opportunity or All Hype?

Lemonade, Inc. (NYSE: LMND) offers AI-powered insurance services that encompass renters, homeowners, car, pets and life insurance. The Company’s insurance carriers in the U.S and EU use bots and machine learning to provide quick and efficient services with minimal paperwork. The Company is leveraging its expertise in Artificial intelligence and machine learning to revolutionize the insurance industry. Lemonade also donates leftover premiums to charities of the customer’s choice through its annual Lemonade Giveback event. The aim is to build a transparent and conflict-free business model that changes the negative image associated with insurance.

Lemonade, Inc. (NYSE: LMND)

Market Cap: $1.75B; Current Share Price: 28.35 USD

Data by YCharts

Strength

The Company launched Lemonade CAR, an automotive insurance business and acquired Metromile (NASDAQ: MILE), a pay-per-mile insurer, marking its first acquisition to bolster its nascent auto-insurance business. The deal will see shareholders of Metromile receiving common shares of Lemonade at a ratio of 19 to 1. The deal is valued at $500 million. Lemonade expects the deal to be transformational for its car insurance business as it believes that it has the potential to have significant impact on three major parameters namely collapsing time, flattening risk, and increasing efficiency.

The Metromile acquisition is likely to add value in the Company’s precision sensors have generated humongous amounts of data covering billions of miles, stored in a cloud that can provide valuable insights into driving behavior such as when, where and how, which can be mapped onto real-time data for evaluating precise predictions for losses per mile driven.

As per its Q3,2021 financial results, the Company reported an 84% YoY increase in In Force Premium (IFP) at $347 million, while premium per customer increased by $254, denoting a growth of 26% YoY. The Company’s customer base increased to 1,363,754, growing by 45% YoY and the gross earned premium grew by $80 million from $43 million in Q3,2020 to $80 million in Q3,2021. The Company achieved $ 50 million sequential increase in IFP, marking the third consecutive record quarter attributed to increase in advertising investment. The business is also witnessing increasing prevalence of bundling and improving loss ratios in its new businesses. There was a record volume of gross new renters’ business, which increased by more than 25% when compared to Q2,2021. Non-renters’ share in the Company’s business mix is up to 47%, while life insurance is at 2% and homeowners’ at 30%. The pet business grew by 15%.

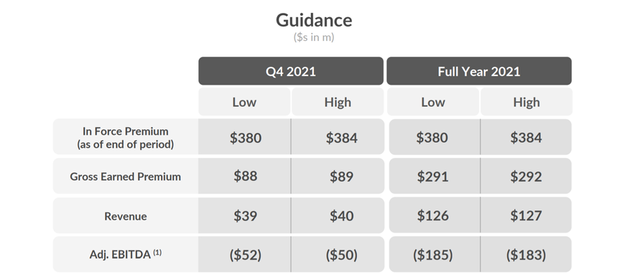

The guidance for Q4,2021 expects In force premium of $380 – $384 million, Gross earned premium of $88 – $89 million, revenue of – $89 million, while full year 2021 In force premium is expected to be $380 – $384 million, Gross earned premium of $291 – $292 million and Revenue of $126 – $127 million. The Company has reduced the FY 21 EBITDA guidance range by $12 million due conservatism on marketing efficiency and costs associated with the launch of Lemonade Car.

Image Source: Company

Weakness

In Q3,2021, Industry-wide increases in media costs resulted in the Company’s marketing efficiency, as defined by the change in IFP driven by advertising spend, decreased by 26%. Furthermore, Lemonade’s Q3,2021 gross loss ratio increased to 77% from 72% a year ago, however the newer products are improving loss ratios. The Company is witnessing improving loss ratios in the home and pet insurance business with concerted effort by the team with measures such as prioritizing profitable locations, improving pricing accuracy and using rigorous CAT management strategy to manage risk.

Total operating expenses of the Company increased by 98% to $82.4 million as compared to $41.6 million driven by increasing sales and marketing expenses, product and technology development initiatives and administrative expenses.

The Company faced tough challenges in 2021, such as the Texas Freeze, which resulted in a huge loss ratio in last year’s first quarter results. Since the Company is pursuing an aggressive growth strategy, with the launch of several new businesses such as Pet, Term Life Insurance and Auto insurance, there is bound to be pressure on its bottom lines and loss ratios.

Another issue is that the Company hasn’t been able to reinsure, availing the services of underwriters to reinsure their policies, which does not count as premium income in the GAAP accounting rules, thereby failing to give a clear understanding of the total premium. The Company gives 70% of its premiums to reinsurance as a way to minimize its risk.

Opportunity

Artificial Intelligence is witnessing burgeoning demand and gaining wide scale acceptance owing to the humongous amount of data being generated by new age organizations. There is a growing need for tools that enable advanced data interpretation, and offer valuable insights, that can be used for serving both internal as well as external customers better. According to a report by Markets and Markets, the artificial intelligence as a service market is expected to reach USD 10.88 Billion by 2023, growing at a CAGR of 48.2%, from USD 1.13 Billion in 2017.

Companies are now using data analytics, to generate actionable insights that will lead to better customer understanding, improved engagement and loyalty. The evolution of technology is also contributing to the rising popularity of digitization, with Artificial Intelligence, Machine learning, IoT and blockchain simplifying the complexities of Digital Transformation.

Data Analytics is bringing about exciting new changes in numerous fields such as agriculture, manufacturing, retail, healthcare and insurance to name a few. Many fields stand to gain from the application of meaningful insights provided by machine driven analysis of complex disparate data, available through various sources.

The implementation of machine learning and artificial intelligence is making skimming through large information sources even easier. The evolution of this technology enables companies to use this information for crucial decision-making involving stakeholders, employees and customers.

The emergence of multi-cloud-based technologies results in use of improved computing mechanisms and more affordable storage. Emerging technology such as blockchain also validates the need and relevance of using data analytics for information processing and decision-making.

An increasing number of organizations are now focusing on their digital customer experience which has opened up numerous avenues for marketing communication and customer engagement. However, the most crucial component of any such marketing strategy is the availability of customer data and critical insights into consumption and usage patterns. This information is a literal goldmine and can act as the foundation for a company’s marketing and customer outreach efforts, it can propel cross-channel marketing campaigns, used for customizing mobile solutions and offerings to customer groups and most importantly to promote engagement and loyalty.

However, increasing concerns about data security and privacy, network vulnerability and challenges with integrating legacy systems with new age systems may hamper the growth and adoption of digital platforms.

According to a report by Data Bridge Market Research, the global artificial intelligence (AI) in insurance market size is expected to reach USD 6.92 billion by 2028, growing at a CAGR of 24.05% in the forecast period of 2021 to 2028. Another report pegs the U.S. insurance industry net premiums at $1.28 trillion in 2020.

Threats

The Company’s differentiating factor is the use of AI in insurance, however established Insurance players have been using AI in their insurance operation for years. Prominent examples include the ABIe (Allstate Business Insurance Expert), being deployed by The Allstate Corporation (NYSE: ALL), which started with answering policy questions through an avatar-driven interface and assisting with the quote process to not only employees but also from agents. The newer version is being designed to engage with the customer directly.

Prudential on the other hand is using AI-based robo advisors to provide support to human advisors. The Company intends real human advisors to become prime users of its robo advisors, thereby leveraging AI to achieve business aims, instead of doing away completely with the human element.

These Companies are only a few examples of behemoths in the insurance industry deploying AI into their operations. These companies have more claim settlement data, data points and customer information to make informed pricing and risk analysis decisions than Lemonade, simply due to their size of operations.

Technology is a constantly evolving field. A breakthrough innovation of today can easily become outdated in a matter of years. To sustain in such a highly competitive environment, companies need to constantly be one step ahead of the competitors in research and development and delivering highly differentiated experiences for their customers.

There is a possibility of a new and better technology emerging in the market, which may render the Company’s technology obsolete. Customers may opt to go with its competitors for their business needs and the Company may fail to acquire new customers or not be able to achieve its targeted growth.

Key Takeaways

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://investor.lemonade.com/news-and-events/events-and-presentations/default.aspx

No Comments