29 Jul Nexgel: Bringing Innovation to the Hydrogel Product Industry

Nexgel, Inc. (NASDAQ: NXGL) provides ultra-gentle, high-water-content hydrogel products for healthcare and consumer applications.

Nexgel, Inc. (NASDAQ: NXGL)

Market Cap: $19.56; Current Share Price: 3.14 USD

Data by YCharts

The Company and its Products

Nexgel manufactures high-water-content, electron beam cross-linked, aqueous polymer hydrogels or gels for wound care, medical diagnostics, transdermal drug delivery, and cosmetics. The Company specializes in custom gels and capitalizes on proprietary manufacturing technologies.

Image Source: Company

Nexgel has historically been a contract manufacturer, supplying gels to third parties who incorporate them into their products. Beginning in 2020, the Company created two new lines of business.

First, the Company expanded into a branded product line that sold directly to consumers. Second, the Company expanded into custom and white-label opportunities, combining gels with proprietary branded products and white-label opportunities. Nexgel’s gel products use proprietary and non-proprietary mixing, coating, and cross-linking technologies.

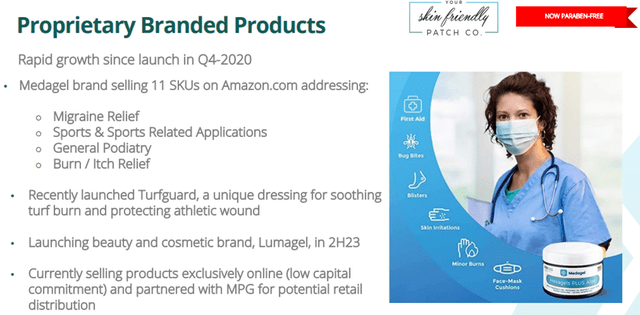

In the third quarter of 2020, Nexgel started selling its branded products using its hydrogel technology on the Amazon marketplace. In 2022, the Company expanded access to its products by launching its direct-to-consumer website, Medagel.com.

Image Source: Company

Nexgel’s hydrogel consumer products are marketed under MedaGel and LumaGel Beauty. The products under the MedaGel brand primarily relate to over-the-counter (OTC) remedy solutions, such as blister and pain applications, while the products sold under the LumaGel Beauty brand primarily relate to beauty and cosmetic solutions, such as wrinkle and skin cream applications. In December 2023, the Company added a third consumer product brand after it had purchased the Kenkoderm brand.

Image Source: Company

Additionally, Nexagel has several more products in its development pipeline. The Company intends for these products to address various market opportunities, including the OTC pharmaceutical drug delivery market, pain management, beauty and cosmetics, sports-related applications, cannabinoids (CBD and/or THC), and general podiatry.

The Company is leveraging its hydrogel products and technologies by allowing other OTC brands to incorporate them into their products. Also, Nexgel created a process where customers can create custom hydrogel products. Customers pay a development fee, eliminating Nexgel’s financial risk in the success or failure of the custom product. Thus, the Company’s custom and white label business will provide customers with a finished product they will brand and re-sell.

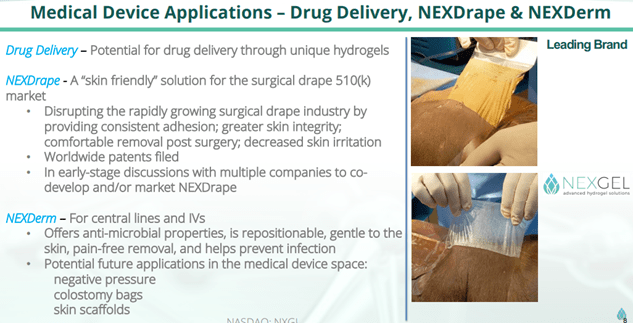

Nexgel has entered the medical device development sector, which focuses on analyzing, creating, and developing devices and solutions that reduce skin pain and irritation, improve and maintain skin integrity, and provide greater comfort and safety for patients at the site where a medical device interfaces with the human body.

Image Source: Company

Below, we will discuss the critical rationale for covering this Company.

- Three-Pronged Growth Effort

Nexgel is dedicated to pioneering advancements across various domains and delivering value to customers and stakeholders. The Company is making efforts to grow through 3 channels:

- Nexgel Inc. Branded Products—Since its launch in the mid-20s, Nexgel Inc. has been increasing its proprietary brands. One such proprietary brand that shows great promise is SilverSeal.

A SilverSeal® study was published in SAGE Journals’ Scars, Burns and Healing publication. The results indicated that SilverSeal demonstrated statistically significant improvement in skin functionality, fewer negative symptoms, and a reduction of scar appearance relative to standard petroleum-based dressing. Nexgel has completed validating the anti-microbial properties of the SilverSeal® product line. The X-Static Silver-impregnated, hydrogel-based product was up to 99% effective in reducing common bacteria, fungus, and yeasts that can be evident in wounds after superficial skin injury.

Image Source: Company

- Custom and White Label—The Company brings proven medical-grade technology to OTC and Beauty and cosmetics for the first time through many new consumer products and This, in turn, creates multiple low-risk revenue paths for the consumer segment, which include Research Development/ Custom Label, White Label, and DTC/E-Commerce Proprietary Brands.

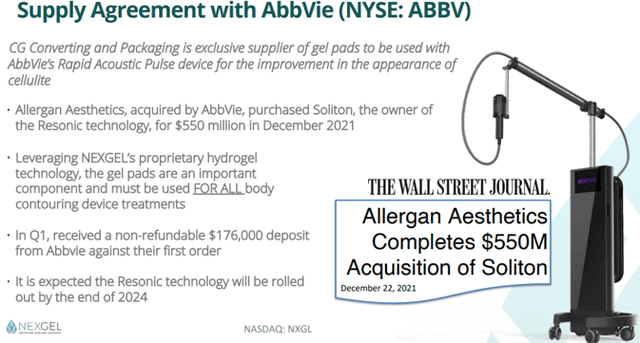

Nexgel leverages its platform to supply OTC brands with unique, gentle, hydrogel-based products as part of its custom and white-label strategy. After extensive due diligence, Nexgel has signed partnership agreements with three multi-billion companies: Haleon, AbbVie, and STADA.

Image Source: Company

On the other hand, the Company’s partnership with European leader STADA Arzneimittel AG was signed in December 2023, and it supports the expansion of NEXGEL OTC’s product portfolio.

Image Source: Company

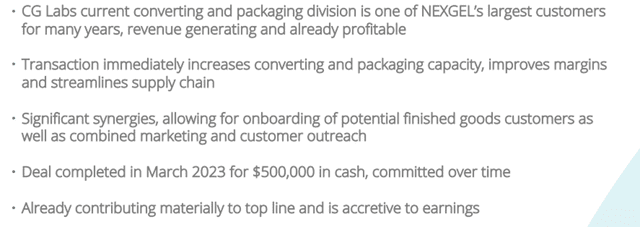

The Company has also entered into a Joint Venture with C.G. Laboratories, consisting of 50-50 ownership in the converting and packaging business in Granbury, Texas.

- Medical Devices – Nexgel addresses the importance of skin integrity and overall skincare with a medical device licensing model. In this context, Nexgel’s hydrogel patch for amblyopia deserves special mention.

Amblyopia is a type of poor vision that typically occurs in one eye but can also occur in both (also referred to as lazy eye). It is the most common cause of visual impairment in childhood and affects approximately 2 to 3 children out of every 100. The global amblyopia market is expected to reach over $6 billion by 2027.

The current standard of care includes patches placed directly on the skin covering the eye, which are difficult to adjust and remove, pulling at and irritating the skin. However, Nexgel’s hydrogel patch is significantly gentler on the skin and manufactured without harsh chemicals or painful adhesives. This product was launched directly to Ophthalmologists and Optometrists in 2H 2023 to gather patient feedback. A potential widescale launch is expected in 1H 2024 and will include DTC.

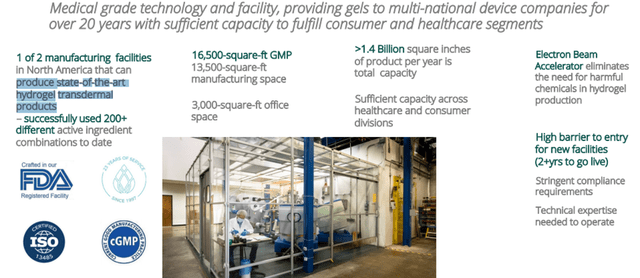

Finally, Nexgel benefits significantly from the competitive advantage provided by 1 of 2 state-of-the-art manufacturing facilities in North America that can produce state-of-the-art hydrogel transdermal products.

Image Source: Company

Additionally, Nexgel has planned capacity expansion to meet expected growth. A 12,000-square-foot expansion of the Texas facility is underway to support anticipated growth in product demand in 2024.

The expansion will support the expected growth in product demand from its strategic partnerships with AbbVie and STADA and retail launch in ’24. It is expected to be completed during Q2 of ’24. New automation equipment has been purchased and will be financed. Moreover, the Company will increase its capacity from 1 to 3 automated machines to significantly increase operational efficiency.

Thus, Nexgel has created multiple growth paths and taken adequate steps to ensure its scalable platform can support the upcoming increase and lead the Company to new heights.

- Financial Performance

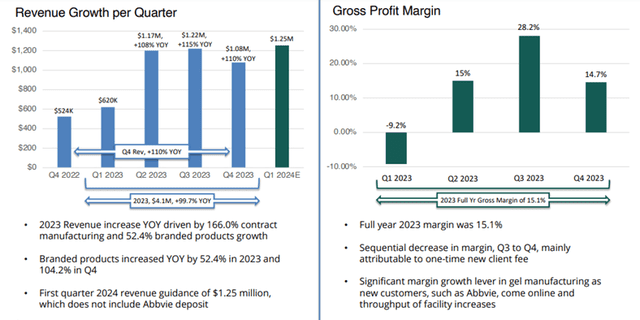

For Q1 FY24, Nexgel’s revenue totaled $1.27 million, an increase of $646,000, or 104%, compared to $620,000 for Q1 FY23. The increase in revenue was driven by sales growth in contract manufacturing of approximately 58% and branded products of 178%.

Gross profit totaled $277,000 for Q1 FY24, compared to a gross profit loss of $57,000 for Q1 FY23. The net loss for Q1 FY24 was $905,000 compared to 807,000 in Q1 FY23.

Image Source: Company

For FY23, revenue totaled $4.1 million, an increase of $2 million, or 99.7%, compared to $2 million for FY22. The increase in revenue was primarily due to sales growth in contract manufacturing of 166% and an increase in branded product revenue by approximately $427,000, or 52.4%, to $1.24 million.

Gross profit totaled $619 thousand in FY23, compared to a gross profit of $256 thousand for FY22. The gross profit margin for FY23 was approximately 15.2% compared to the gross profit margin of 12.5% for FY22. The net loss for FY23 was $3.2 million compared to $4.7 million for the same period the year prior.

Risks

Nexgel has a promising future. Nevertheless, the Company is subject to certain risks; for example, the Company may be unable to raise sufficient capital to execute business plans. There may be entry of new competitors in the industry, adverse federal, state, and local government regulations, and technical problems with research and products. All of these may impact Nexgel’s future performance.

Conclusion

Nexgel demonstrated nearly 100% growth in revenues, or more for FY23 and Q1 FY24, compared to the same periods a year ago. The Company has created pioneering products for rapidly growing markets. Nexgel’s SilverSeal wound care product is aimed at the scar treatment market, which is expected to reach $45.0 billion by 2028. The Company has also launched products for the global amblyopia market, which is expected to reach $6 billion by 2027.

Nexgel’s product pipeline and performance over the last few quarters indicate that the Company is poised to grow exponentially. However, Nexgel is exposed to certain risks, such as the entry of new competitors and the inability to raise sufficient capital to execute business plans. Hence, investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1468929/000149315224014127/form10-k.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1468929/000149315224018950/form10-q.htm

Sorry, the comment form is closed at this time.